China remains the main export driver while India gains momentum as a future manufacturing hub

The PCTC market remained stable through November, supported by firm vehicle export demand and solid production activity across key regions. China continued to anchor global output, with October manufacturing reaching new highs and electric vehicle production expanding at a strong pace.

China maintains strong production and export momentum

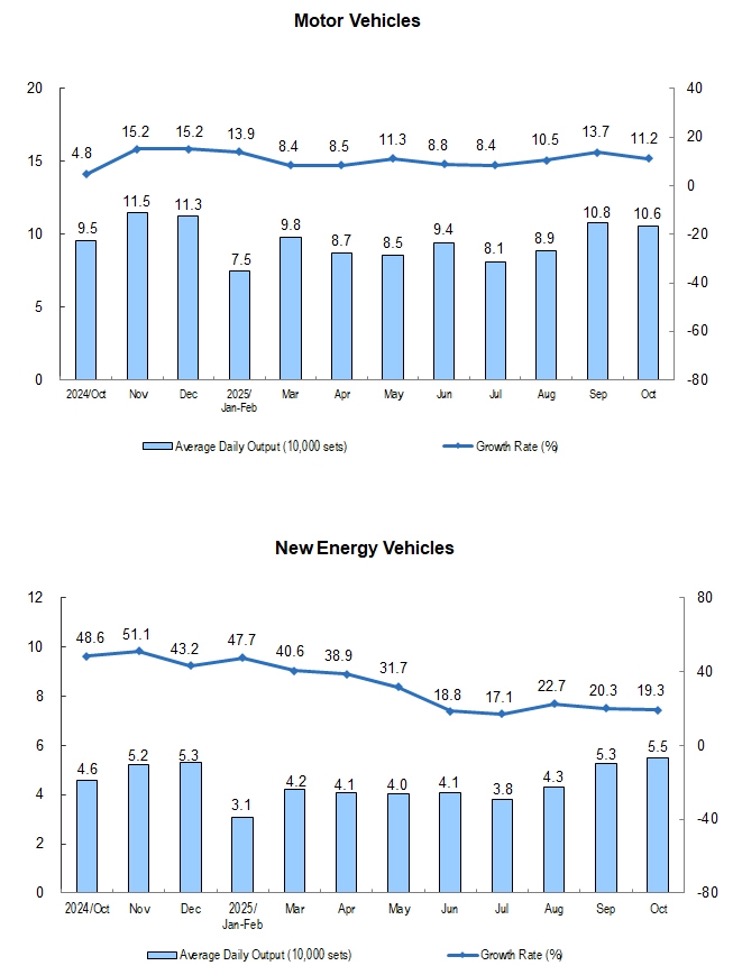

China kept its position as the leading supplier of finished vehicles, with growing neighbourhood electric vehicle (NEV) output and rising sales supporting continued export activity. Recent figures show Chinese Industrial value-added in auto manufacturing rose 16.8% y/y in October, while fixed-asset investment grew 17.5% in Jan-Oct — the fastest in several years. Vehicle output reached 3.28m units (+11.2%), including 1.71m NEVs (+19.3%), pushing lithium-battery production up 30.4%. The one-year agreement to maintain rare earth mineral exports removed a major risk for the EV supply chain and helped preserve near term stability in trade flows.

India gains attention as Japanese automakers expands locally

India saw rising passenger vehicle sales alongside new investment commitments from Toyota, Honda and Suzuki to expand production and export capacity. This reflects a gradual shift toward diversified supply chains. While most PCTC trade flows still originate from China, India’s growing role signals future changes in regional shipping patterns.

Sources: Clarksons, Financial Times & National Bureau of Statistics of China (NBS)