Why it matters, and what comes next

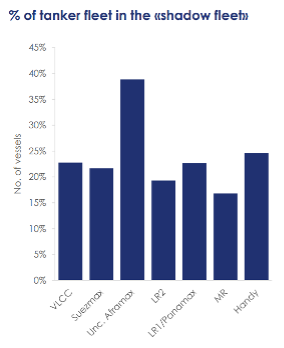

The shadow fleet – tankers transporting oil from sanctioned nations like Russia, Iran, and Venezuela – has become a central factor in the tanker market. These vessels, often operating with limited oversight and no standard vetting, now make up an estimated 23% of the global fleet. Most are older ships, with an average age of 23 years, and over half above 20, making them significantly less efficient than compliant tonnage.

Recent events have brought renewed attention. This week, the UK sanctioned 100 vessels, and the EU followed with 189 more, now targeting over 340 ships involved in grey trade. Meanwhile, geopolitical tensions have flared in the Baltic, where Estonia attempted to block a shadow vessel en route to Russia.

With enforcement increasing and political dynamics shifting, the shadow fleet’s future is a key factor for market fundamentals.

What could change going forward?

Several scenarios could reshape the shadow fleet’s role:

- US-Iran deal: A nuclear agreement could bring Iranian oil back to compliant trade, reducing shadow fleet demand, and hence increasing demand for compliant tankers that replace this trade.

- Russia-Ukraine peace: Unlikely in the short term, but would shift volumes to the compliant fleet if sanctions ease, as Russian crude and product exports will be replaced by compliant tonnage.

- No major change: Shadow fleet activity would continue, but face rising regulatory pressure and operational risk.

Market outlook: What happens if sanctions are lifted due to both Russia-Ukraine peace and US-Iran de-escalation?

- A large share of the shadow fleet would no longer be needed, particularly older vessels that are unlikely to meet compliance standards.

- This could result in a significant reduction in effective fleet capacity, causing short-term tightening in the compliant tanker market.

- Many shadow fleet vessels are too old (average age: 23 years) to return to mainstream use. These ships would likely be scrapped or phased out (around 50% of the shadow fleet)

- Fleet growth would likely turn negative in the short term due to the removal of old tonnage without immediate replacement.

- Crude tanker demand could increase by 40–100 Suezmax equivalents (20-50 VLCCs) depending on where Iranian oil exports go, especially if trade shifts back to Asia and Europe.

- Sailing distances for the Russia crude and product trade will see a decline, which will be offset by the anticipated scrappings of old sanctioned tonnage (see figure from Clarksons above).

- While some oil majors have publicly stated they will not charter ex-shadow fleet vessels, younger and better-maintained tankers from this segment may eventually be reabsorbed into the compliant fleet (to be realistic).

- Demand for newbuilds could rise to replace lost capacity, particularly in the crude segments.

- Over time, a more stable and transparent tanker market would emerge, with fewer operational and regulatory risks. But before this, a period of elevated rates for compliant tankers are expected if the majority of the shadow market disappears!

Conclusion: Mostly upsides for the compliant market

The shadow fleet has grown into a central part of global oil shipping, but its future is tightly linked to global politics. Whether through a lifting of sanctions or a continuation of enforcement crackdowns, its role is likely to shift significantly. For the compliant market, this creates mostly upside-risk – tighter supply, stronger freight rates.

Source: BRS, Clarksons, OFAC and Tradewinds

Source of figure: Clarksons