Rising geopolitical risk skews sentiment to the upside

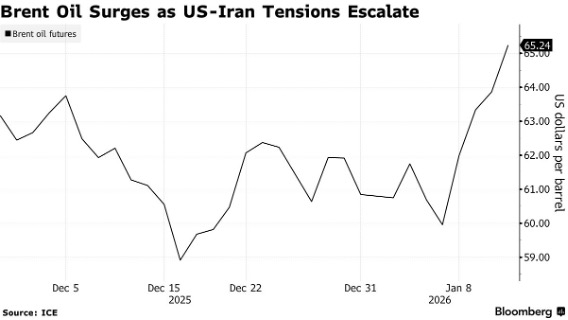

Geopolitical tensions surrounding Iran continue to intensify, with President Trump signalling a tougher stance toward the capital Tehran, including a proposed 25% tariff on goods from countries “doing business” with Iran. While there are no confirmed disruptions to Iranian crude exports at this stage, the rhetoric has contributed to a sharp increase in perceived geopolitical risk, prompting a swift reaction across oil markets.

Crude prices have rallied accordingly, with Brent up roughly 9% over the past four sessions and WTI reaching its highest level since early November. The situation in Iran has added to existing concerns about oil supply. Problems at the Caspian Pipeline Consortium terminal have significantly reduced oil exports from Kazakhstan. Shipments have been cut to about 900,000 barrels per day due to bad weather, drone attacks, and maintenance work.

Disruption set to lower global crude supply, boost tanker rates

At the same time, there is a risk that Iran’s exports, around 2 million barrels per day, could also be disrupted. This has reduced worries that the global oil market will face an oversupply in the near future and support the tanker outlook. From a tanker market perspective, risks are skewed to the upside, as heightened geopolitical uncertainty typically supports freight rates through higher risk premiums and potential routing inefficiencies, even without direct supply disruption.

Iranian crude exports also remain subject to US sanctions and largely move outside the compliant tanker system, meaning any change in enforcement or political direction could redirect volumes toward compliant tonnage and further support mainstream tanker demand.

Sources: Bloomberg & Fearnleys