Tanker outlook positive for 2025

Rising crude demand set to boost the year ahead

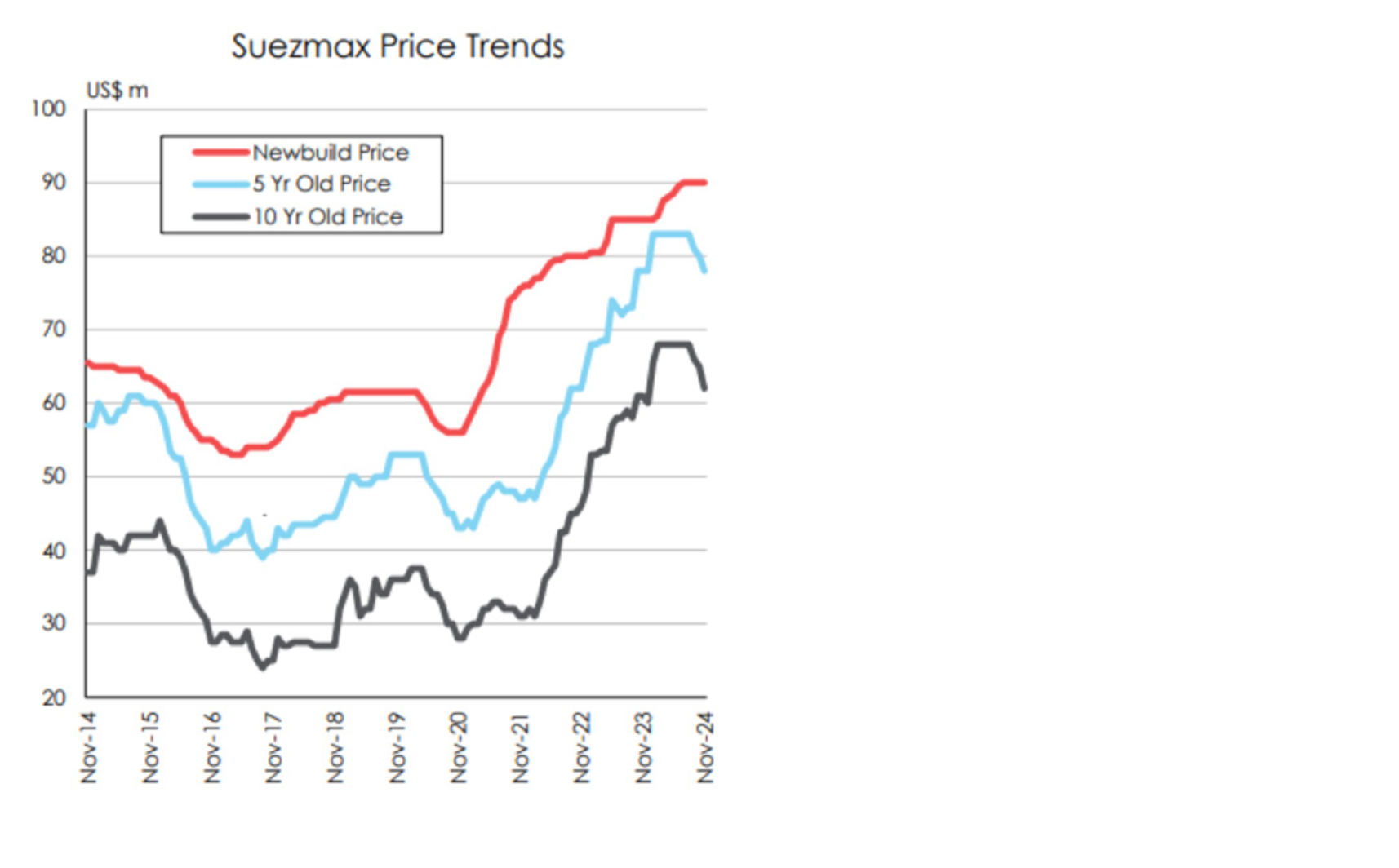

By early December, average crude tanker earnings hovered around $36,000/day. Suezmax and Aframax have showed the most resilient segments. Seasonal improvements that typically bolster the fourth quarter have yet to fully materialize. However, shipbrokering house Fearnleys forecasts a potential rate rally in Q1, driven by seasonal shifts – offering a more optimistic outlook for the months ahead.

OPEC+ decided to extend its production cuts until March 2025, reflecting a cautious approach to market rebalancing. The an- ticipated easing of these cuts in March is expected to positively impact the tanker market.

Despite not reaching the peak rates recorded in the same period last year (Q4), 2024 has been a positive year for the tanker sector overall, buoyed by strong growth in Chinese imports. In Novem- ber, seaborne Chinese crude oil imports rose by 3% month-on- month to an estimated 9.9 million barrels per day. This marked an 8% year-on-year increase, according to Clarksons.

Chinese exports growth crucial to a promising 2025

Lower Middle Eastern crude prices encouraged stockpiling, supporting this growth. Additionally, Chinese product exports surged by 30% month-on-month to 0.9 million barrels per day, with gasoline exports rebounding as refiners maximized profits ahead of export tax rebate changes in December.

Looking ahead, the crude tanker sector holds promise for 2025.

Crude demand is projected to grow by 2.3%, while fleet expansion remains limited to just 1.2%, according to Clarksons. This favourable supply-demand dynamic could pave the way for stronger earnings and a well-balanced market, setting the stage for a positive outlook in the coming year.

Source: Clarksons research

EU and US step up sanctions on Russian exports

Tanker demand set to increase as 52 more vessels are blacklisted

During the last month, there has been notable increase in sanctions targeting Russian oil and maritime activities as Western govern- ments intensify economic pressure on Russia over its ongoing war in Ukraine.

According to Tradewinds, The European Union has black- listed 52 more ships, bringing the total number of Russian-linked vessels sanctioned by the EU to 79. These ships – involved in trans- porting oil, arms, and grain – are part of the EU’s strategy to disrupt Russia’s shadow fleet, which helps circumvent sanctions.

The newly sanctioned vessels include 42 crude and product tankers, 7 LNG carriers, and 3 cargo ships, many flagged by Barbados. Some of these ships had already been sanctioned by the US and UK. The EU’s actions also target Chinese companies supplying drone compo- nents to Russia, marking a broader enforcement effort.

US sanctions introduced – doubts whether they’ll remain in place

Meanwhile, the US is preparing to impose even stricter sanctions

on Russian oil exports. According to reports from Bloomberg, these sanctions will likely target shipping fleets involved in transporting Russian oil. While specifics are yet to be confirmed, this move aims to increase economic pressure on Moscow.

However, concerns about the effectiveness of these sanctions re- main, particularly as China continues to buy Iranian oil, which has already been sanctioned. There is also uncertainty regarding the stance of a potential Trump-led administration and whether it would pursue the same tough measures on Russian oil exports.

For the tanker market, these sanctions could have significant im- pacts. A reduction in Russian oil exports could lead to increased demand for tankers, especially if oil from regions like OPEC or the Atlantic Basin fills the gap. This shift could drive up freight rates and market activity, benefiting tanker operators as global shipping dyna- mics adjust.

Source: tradewindsnews

Rising opportunities for green ammonia

Huge momentum in VLGC market as IMO clears ammonia for ship fuel use

The VLGC market gained strength during December, with freight rates climbing significantly. This surge was driven by decreasing ves- sel availability and a growing preference among charterers for larger vessels, signalling robust demand dynamics in the sector. Meanwhile, the industry is also making strides toward decarbonization.

The IMO recently approved guidelines to enable ammonia as a viable ship fuel, aligning with its 2050 net-zero emissions target. Ammonia offers a carbon-free alternative when produced from green hydrogen. The new guidelines, effective July 2025, outline safety measures and regulatory amendments to facilitate its adopti- on. EMF, with its fleet of three Very Large Ammonia Carriers (VLACs) delivering in 2027, is well-positioned to benefit from this shift.

Massively ambitious Argentinian production scheme in the offing

Adding to the long-term positives, Argentina is advancing its role in the green energy transition. RP Global and GIZ are developing a flagship mega-project in the country, aiming to produce 1.7 million tons of green ammonia annually, powered by 4.2 GW of wind ener- gy. This initiative will primarily serve the European market, creating significant demand for specialized ammonia carriers like VLACs.

The project not only supports decarbonization in Europe but also un- derscores Argentina’s potential as a leading exporter of renewable energy products.

Looking ahead, the LPG market may face softer conditions in early 2025 due to fleet expansion. However, according to Clarksons, de- mand is expected to pick up later in the year. By 2026, tonne-mile growth for LPG and ammonia is forecasted at 8.5%, driven by increa- sed US export capacity and easing Red Sea disruptions. These trends highlight a promising future for both LPG and ammonia carriers, with expanding opportunities for the shipping sector.

Another strong year for the car carrier market

China emerges as global top exporter: Trend set to continue

The PCTC market had another strong year in 2024, characterized

by high earnings, robust freight rates, and an active charter market. Seaborne car trade volumes remained solid throughout the year, building on the strong recovery post-COVID.

China has now surpassed Japan as the largest exporter of cars by sea, with exports growing by 26% this year. In November, Chinese car exports totalled 548,600 units, indicating a year-on-year growth of 4.7%. Chinese year-to-date exports are up 23%, showing that de- mand for Chinese vehicles remains strong.

Long-haul exports from China have been a key driver of shipping demand, alongside changes in trade routes. The ongoing rerouting of vessels away from the Red Sea has added approximately 7% to car-mile demand as the vessels take longer routes via the Cape of Good Hope. These factors have helped support the car carrier mar- ket in 2024.

Tariffs a concern – though not predicted to hinder 2025 growth

While some challenges are on the horizon, they are not expected to create significant disruption in the market. The EU has introduced tariffs on Chinese electric vehicle (EV) imports, which account for about 12% of China’s car exports. Although this may modestly slow growth in the EV sector, Chinese EVs are expected to retain their competitiveness due to their strong pricing advantage. In the US, potential trade policy changes could introduce new tariffs, but the extent of their impact remains uncertain.

Looking ahead the outlook remains positive. Growth in Chinese exports and evolving trade patterns continue to support long-term demand for car carriers. Although risks such as demand normali- zation, trade tariffs, and geopolitical disruptions persist, 2024 has been yet another remarkable year for the PCTC segment, setting the stage for steady performance in the years to come.